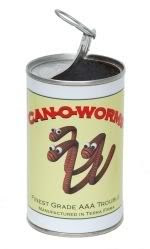

Image via photobucket.com

Rusty Little

A can of worms to be used as bait by a fisherman is easy to open, but not so easy to close. Once the wriggling worms discover the opportunity to escape, it is difficult to contain them.

Groupon and Living Social are two of the most popular Internet companies offering online discount vouchers for deals at your favorite restaurant, golf course, auto mechanic, or other local business. Since Groupon is the largest and most popular, we’ll use it here as an example.

Snapshot of how it works:

- Groupon sends an e-mail alert notifying the customer that a restaurant has posted a $20 voucher for sale at a price of $10.

- Customer goes online and purchases the $20 voucher for $10.

- Customer dines at restaurant and incurs a bill of $25 (ignore sales tax for the time being).

- Customer gives the $20 voucher to the restaurant along with $5 cash for the difference.

- Restaurant notifies Groupon that the voucher has been redeemed; Groupon sends 70% of the $10 voucher purchase price to the restaurant; and Groupon retains 30% as a “promotion and distribution fee.”

- At the end of the day, Groupon has received $3; the restaurant has received $12; and the customer has paid $15 for the meal.

(For more details, you can review the Groupon Merchant Account Terms and Conditions here).

That all seems straightforward enough until you consider the can of worms it opens up for sales tax purposes. What is the purchase price of the meal? Is it the $25 on the total bill? Is it the $15 the customer actually paid? Is it the $12 that the restaurant ultimately received? Is the discount voucher being offered by the restaurant or by Groupon (possibly similar to a third party coupon)? Is this simply a reduction in sales price by the restaurant? Is this really a gift certificate? What is really happening here?

New York and Massachusetts attempted to address these issues recently in

TSM-M-11(16)S and

Working Draft Directive 11-XX, respectively. Even in the titles of these two state releases, there are notable differences in semantics with New York referring to them as “prepaid discount vouchers” and Massachusetts calling them “third party coupons.”

Not surprisingly, both New York and Massachusetts determined that sales tax should be based on the $25 in the example above. New York stated that it will treat the discount certificates as stated face value vouchers and, although no statutory basis for its conclusion was provided, that the gross sales price is the taxable amount. Massachusetts essentially classified the “third party coupons” as gift certificates based on its statutory definition of gift certificates and determined that the gross sales price in a purchase is subject to sales tax accordingly.

However, another worm that attempts to wriggle out of the can is the fact that many (possibly most) Groupon deals are for a specific item or service and are not denominated in dollars. The Groupon may be “$20 for two seafood dinners,” “$20 for a one hour massage,” or “$50 for a one-night hotel stay.” Interestingly, New York did address specific product offers such as these and reached a contradictory conclusion. For specific product vouchers, the taxable value is the amount paid for the voucher and not the value of the product (assuming the product or service is taxable in New York). How can New York tax the entire “value” of the meal in our example above, but only tax the amount paid for the certificate if the deal had been denominated by the product and not in dollars?

Regardless of the conclusions reached by New York and Massachusetts, there is a good case to be made that the $15 price in our example is the taxable amount. The

terms of the Groupon Agreement are too extensive to restate here but, in a nutshell, the merchant is the party that makes the offer for a discount deal and not Groupon. It seems clear under the terms of the agreement that the “deals” are nothing more than the merchant choosing to offer a discount on its prices, and it is the discounted price, therefore, that should be subject to sales tax.

In addition, if the merchant chooses to do so, a deal does not go “live” unless a minimum number of purchases are made. This is the group buying power model that Groupon was built on, and a “negotiated” lower price should be the amount subject to sales tax. If a merchant chooses to reduce its sales price because of the buying power of its customer(s), then the discounted sales price has always been the sales tax base for sales tax purposes. But as discussed in our recent

SALT To Taste article, the states have already proven in the recent highly publicized discount travel company cases that they are willing to recharacterize what is being sold (and by whom) for their benefit.

The can of worms opened with the Groupon business model is not just limited to sales tax issues. Unclaimed property comes immediately to mind, but we’ll save that discussion for a later day.